The Unique Needs of Temporary Staffing Firms

Staffing companies face unique cash flow challenges. This guide explains how invoice factoring can alleviate those challenges.

The Payroll Gap

One of the biggest challenges faced by staffing agencies is the gap between when they pay their workers, and when their clients pay for those workers’ services. In many cases, staffing companies pay their workers weekly or bi-weekly, but the staffing company’s client will take 30 days or more to pay the invoice from the staffing firm. This causes quite a gap between the outgoing payroll expenses and incoming client payments and can leave a company without enough funds to make payroll or fund operations.

This situation can intensify during peak periods or times when seasonal demand spikes. At these times staffing companies not only have more workers to pay, therefore higher payroll, they can also incur higher recruitment and training costs which are not always passed along to the clients.

Expansion and Growth

In addition to the ongoing issue of financing the payroll gap, most companies want to grow their businesses. Growth and expansion require investment and investment takes cash.

So what options are available to staffing companies to fund growth AND deal with financing the payroll gap?

Funding Options

There are a number of funding options available to companies – angel investors, crowdfunding, merchant cash advances, small business loans, and invoice factoring are some options, but one of those has distinct advantages for staffing companies.

Invoice Factoring Explained

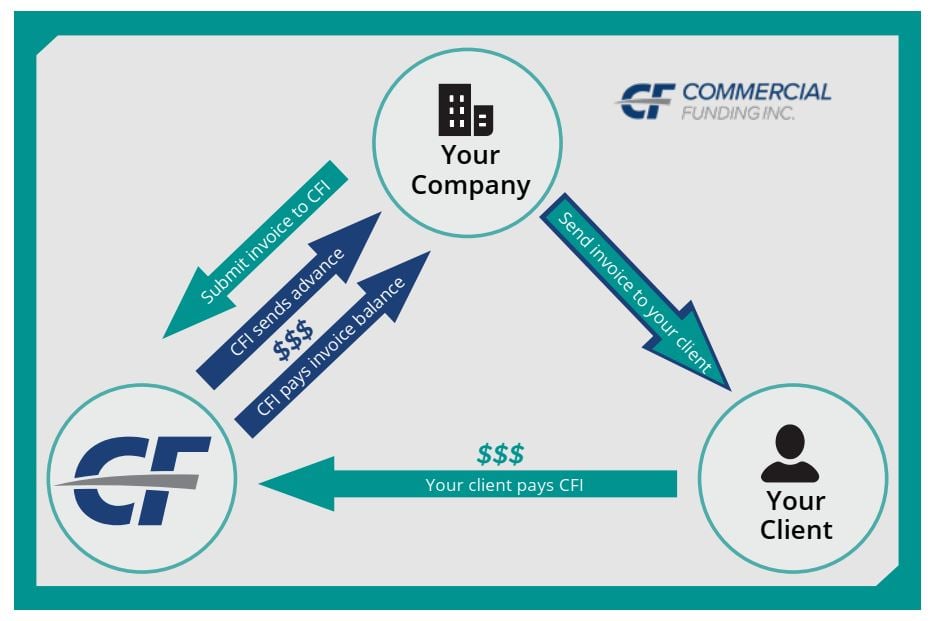

Invoice factoring is a quick, cost-effective way for business-to-business (B2B) companies, including staffing companies, to improve cash flow by receiving faster payment of their invoices. It’s a great alternative to bank loans or high-rate loans such as merchant cash advances. The information contained in this guide explains what invoice factoring is, how it works, how it compares to other forms of financing and how your company can use it to improve cash flow and grow your business. The graphic below provides a visual representation of how this works.

Invoice Factoring is Great for Staffing Companies

Invoice factoring is a great way to improve cash flow without incurring additional debt. But how do you determine if factoring is right for your business? There are 4 main considerations when determining if invoice factoring is a good fit; 1) customer type, 2) how you bill your customers, 3) how your customers pay, 4) how long it typically takes for your customers to pay. Our blog post, Is Invoice Factoring Right for Your Business, provides all the details make an informed decision.

The Benefits of Invoice Factoring

Improved Cash Flow

Invoice factoring provides companies with immediate access to funds by converting their accounts receivable into cash. It is also the only form of financing that grows proportionally with your sales. As you grow your business and invoice greater amounts, the amount of cash that you are potentially eligible to receive from factoring grows.

Factoring is Fast and Easy

Initial funding can be as quick as 48 hours with subsequent funding within 24 hours or in some cases same day.

No Debt to Repay

There is no need to worry about the added liability incurred with a bank loan. Factoring isn’t a loan, which means businesses do not take on additional debt. This can be advantageous for businesses with a cash flow deficit, or those that do not qualify for traditional loans.

Factoring Helps Build Business Credit

Getting paid faster on your invoices improves cash flow, enabling you to meet your credit obligations in a timely manner. When you have adequate cash flow and pay your bills on time, you establish or improve your business credit rating.

Your Customer’s Credit is Important

Unlike traditional bank loans, invoice factoring approval is based in part upon the creditworthiness of the business’s customers. The payment of your invoices by your customers is what pays the factoring company. For that reason, your factoring partner is focused on your customers’ credit worthiness. This is especially helpful if your company is young, growing rapidly, or still building credit, or if you’ve had recent credit issues.

Your Access to Cash Grows with Your Company

As your company grows and you place more workers in temporary positions, your accounts receivables grow. This means you have more invoices to factor and therefore may receive larger up-front advances from your factoring company to accommodate your growth.

What to Know Before You Start

When selecting an invoice factoring partner, there are some critical things to consider – industry expertise, dedicated account management, services, fee structure.

Industry Expertise

When selecting an invoice factoring company, it is crucial to find a partner that understands the industry in which you operate. When your factoring partner understands your industry, they understand your business and your customer base. They know the terminology, understand the invoicing and verification processes, and can speak more intelligently with your customers. They may also have experience and existing relationships with many of your customers which can expedite the approval and funding process.

Dedicated Account Management

When you need funding or have questions, you don’t want to solely rely upon a website nor do you want to call a 1-800 number and spend time pushing buttons, dealing with a recorded voice, or waiting on hold. Your business deserves a dedicated resource to whom you can direct questions and rely on for quick responses. When vetting potential factoring partners, ask about their lines of communication and if you will have a personal, dedicated account manager.

Additionally, ask what type of access you will have to your account information. Some factoring companies offer an online customer portal that allows you to upload invoices, check on payments, review statements, and more. This type of access makes it easy for you to get insight into your account and manage the relationship as well as expediting your funding requests.

Services

In addition to basic invoice factoring, some companies offer additional complementary services, such as invoice processing, cash management services, and credit reviews for new potential clients. You may not need any or all these services, especially at the beginning of a factoring relationship, but it’s good to understand what’s available.

Fee Structure

Fee structures from factoring companies can vary so it’s important to understand how the company is charging fees.

Prior to signing an agreement and taking on a new factoring partner, be sure to read the contract in full and ensure that you and your team are on board with all the details.

Contracts can be confusing and complex so take time to ask questions to ensure you understand them before signing any contracts.

Work with Commercial Funding and Conquer Your Capital

Commercial Funding has a great deal of experience working with staffing companies. We’ve worked with staffing companies that provide labor for the following industries and jobs: manufacturing, administrative, engineering, security, medical, distribution, and more.

When working with CFI, you will always have a dedicated individual who serves as your personal Account Manager (AM). When you need information or assistance, you simply dial your AM’s direct line. No 800 number to call, no robot voices to listen to, no buttons to push. A simple direct phone call is all you need. CFI maintains a customer portal you can access 24/7 to get a complete view of your account and the factoring relationship.

Lastly, CFI never surprises customers with hidden or unexpected fees. Upon signing your invoice factoring contract, you’ll always know what to expect.

When you work with Commercial Funding Inc., you receive money for your invoices quickly. Now, when opportunity knocks, you’ll have the cash in hand. No longer will your business be impacted by delayed invoice payments. With immediate cash in hand, you can now instantly address payroll obligations, emergency maintenance costs, unsuspected overhead, or reinvest that added capital back into your brand to expedite your business growth!

You’ve Selected an Invoice Factoring Partner. Now What?

Managing the Factoring Relationship

Once you have been onboarded, you will be assigned your own Account Manager (AM). Someone at your company (you, your accounts receivable manager or your bookkeeper) will become good friends with your AM. Why? Because typically you will deal with them on a regular basis as they help you through the factoring process and get you the cash you need when you need it. You will regularly send them invoices and documentation, they will coordinate ongoing funding and can help you reconcile your books and provide you with information you need. The relationship between you and your account manager will become critical to a good factoring experience. At CFI you will never have to worry about talking to an automated message on the other end of the line or worrying about a gap of knowledge when dealing with the industry in which you operate. At CFI, our team is filled with experts that will dedicate themselves to serving your every need and who understand your business and the industry in which you operate!

Preparing Your Invoices

Once your account has been set up, the next step is to prepare your invoices.

For some industries, the invoice itself is only part of the paperwork required to verify invoices. Quite often for staffing companies, in addition to the invoices, many companies require that timesheets be signed and submitted before an invoice can be paid. These timesheets can be submitted through the CFI customer portal along with the invoices.

Your dedicated account manager will work closely with you and your business to outline the exact expectations and coordinate a consistent funding schedule along with the submission of appropriate documentation so you may receive payment for your invoices as quickly as possible.

Evaluating the Results and Tracking Ongoing Progress

A sophisticated accounts receivable financing company will provide you with detailed reports on the status of your receivables, which helps you better manage your business and cash flow. This can also help reduce the amount of time you spend preparing reports and allows you to focus on your business. CFI’s customer portal conveniently aggregates handy reporting tools to track your accounts receivable, invoices and documentation submitted, and payments received, and monitor the additional funding you can receive for your business.

Invoice factoring is an advantageous lending option for temporary staffing agencies. Factoring can alleviate cash flow challenges felt while waiting up to 90 days for payment and can be a convenient alternative to more restrictive bank loans. A real factoring partnership can serve to alleviate administrative stress and pave the way for long-term growth for your business!